Morgan & Morgan asesoró a CM Realty, S.A. en su registro como Sociedad de Inversión Inmobiliaria ante la Superintendencia del Mercado de Valores de Panamá y la colocación de sus Acciones Comunes Clase B a través de la Bolsa de Valores de Panamá, S.A.

Morgan & Morgan brindó servicios legales a CM Realty, S.A. (“CM Realty”) en el proceso de constituirse en una Sociedad de Inversión Inmobiliaria o SII que cumple con los requisitos para gozar del régimen fiscal especial previsto en el Parágrafo 2 del Artículo 706 del Código Fiscal de Panamá. Para los efectos antedichos, Morgan &

Morgan & Morgan entrega Informe de Sostenibilidad 2015 al Foro de las Naciones Unidas

Nuevamente Morgan & Morgan reafirma su dedicada gestión en todos los ámbitos relacionados con la Responsabilidad Social Empresarial fijados en los 10 Principios que constituyen los pilares de la Red del Pacto Global. El informe completo está disponible en nuestro sitio web Morgan & Morgan – Informe de Sostenibilidad 2015

- Published in News

Joining efforts to build a more sustainable society

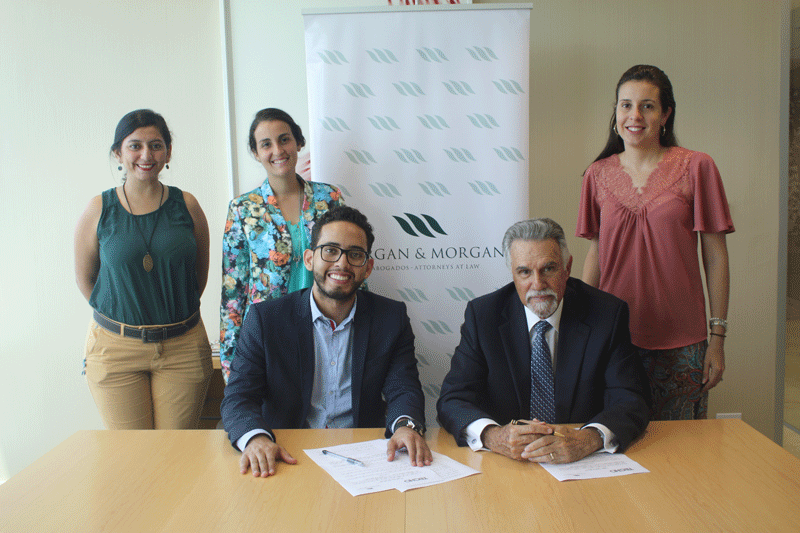

Morgan & Morgan firmó un convenio de cooperación con TECHO mediante el cual la firma se compromete a ofrecer apoyo legal pro bono a las comunidades que TECHO apoya, además de sensibilizar sobre el flagelo de la violencia doméstica y cómo prevenirla. La misión de TECHO es alcanzar una sociedad justa y sin pobreza, donde

- Published in News

Morgan & Morgan asesoró a Wells Fargo Bank, National Association y The Prudential Insurance Company of America en relación en titularización flujos futuros por US$250 millones

Morgan & Morgan asesoró a Wells Fargo Bank, National Association y The Prudential Insurance Company of America, con respecto a los aspectos legales de Panamá, en su papel como inversor en un nuevo programa de derechos de pago diversificados, formando parte de la titularización de flujos futuros de fondos representados por las órdenes de pago

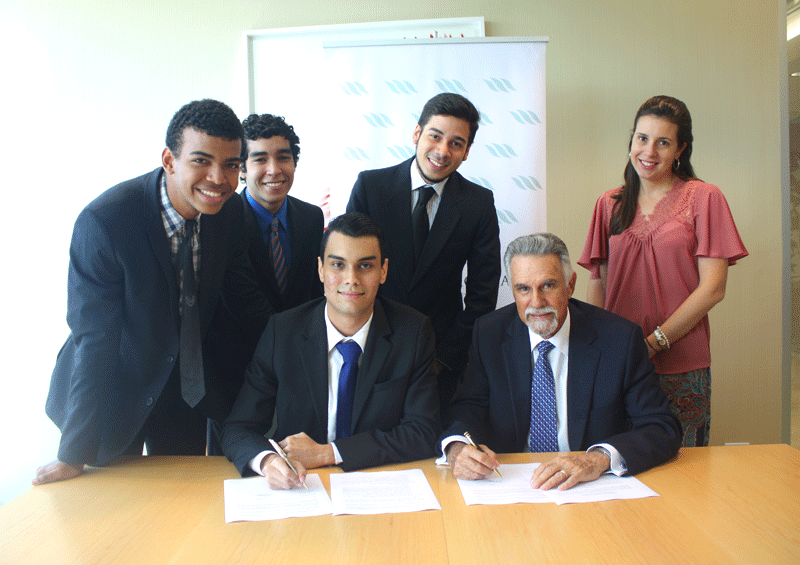

Sumando esfuerzos para que la educación llegue a más panameños

Morgan & Morgan y el Instituto Panameño de Educación por Radio (IPER) firmaron un convenio de cooperación mediante el cual la firma se compromete a ofrecer servicios legales de manera pro bono para re-organizar la estructura legal de esta institución. La misión de IPER en nuestro país es facilitar la educación a jóvenes y a

- Published in News

Orgullo e historia para Morgan & Morgan

El buque de gas licuado Lycaste Peace, de la compañía japonesa NYK Line, se convirtió este lunes 27 de junio de 2016 en el primer barco de bandera Panameña en transitar el Canal ampliado, después de su inauguración. NYK Line es una de las mayores compañías de transporte del mundo, parte del consorcio Mitsubishi, uno

- Published in News

Alianza por el futuro de la educación en Panamá

Morgan & Morgan y Ayudinga Media firmaron un convenio marco de cooperación mediante el cual la firma se compromete en apoyar de manera pro bono en la estructura legal y financiera de este proyecto educativo que busca innovar las metodologías de enseñanza de una manera creativa. Esta alianza, permitirá el crecimiento a nivel exponencial de

- Published in News

Morgan & Morgan participa en Conferencia Anual de Derecho Penal en Panamá

Del 11 al 13 de mayo de 2016, la ciudad de Panamá fue sede de la 19ava Conferencia Anual del International Bar Association (IBA) sobre Derecho Penal Transnacional, organizada por el Comité de Derecho Penal del IBA con el apoyo del capítulo de Latinoamérica de esta misma asociación. El Grupo Morgan & Morgan participó como

- Published in Sin categorizar

Morgan & Morgan advised Shanghai Gorgeous Investment Development Inc. in the acquisition of Panama Colon Container Port, Inc. and subsidiaries

Morgan & Morgan acted as Panamanian counsel to Shanghai Gorgeous Investment Development Inc., with respect to the acquisition of Panama Colon Container Port, Inc. (PCCP) and subsidiaries, a company with a concession granted by the Panamanian Maritime Authority, to build and operate the port of Isla Margarita in the province of Colon, Republic of Panama.

- Published in Ana Castrellon, expertise-es, Inocencio Galindo

Regulations of Interest – Taxes – Law 62

Law 62 of October 5, 2012. By which provisions are adopted to allow implementation of certain commitments under the Trade Promotion Treaty between the Republic of Panama and the United States of America. Amendments are introduced to specific articles of other laws to suit them all to the commitment system in the said treaty with