Morgan & Morgan outstands in The Legal 500 Green Guide Latin America 2024.

Panama, February 15, 2024. Morgan & Morgan has been recommended in the second edition of the global guide: “The Legal 500 Green Guide Latin America 2024”. This is the first time that a Panamanian firm is highlighted in this reference guide of law firms specialized in environmental, social, and governance (ESG) practice area, being, in our case,

- Published in News, Ana Castillo, Ramon Varela

Morgan & Morgan outstands in The Legal 500 Latin America 2024.

Panama, October 25, 2023. With 30 attorneys and eleven ranked practices, Morgan & Morgan heads the Panama chapter of The Legal 500 Latin America 2024 edition. In addition, nine practice areas receive the top Tier 1 ranking in the publication. Recommended individuals: Alejandro Chevalier: Dispute Resolution. Allen Candanedo: Intellectual Property. Ana Carolina Castillo: Projects and Energy. Andres V.

- Published in Alejandro E. Chevalier, Allen Candanedo, Ana Castillo, Andres V. Mejía, Aristides Anguizola, Banking and Finance_news, Corporate Services_news, Energy and Natural Resources_news, Fanny Evans, Francisco Arias, Francisco Linares, Inocencio Galindo, Intellectual Property_news, Jazmina Rovi, Jose Carrizo, Juan David Morgan Jr, Kharla Aizpurua, Labor Law_news, Litigation and Dispute Resolution_news, Luis Raven, Luis Vallarino, Maria Teresa Mendoza, Mayte Sanchez, Mergers and Acquisitions_news, Miguel Arias publi, Milagros Caballero, Nestor Broce, News, Omar Rodriguez, Orlando Tejeira, Projects_news, Ramon Varela, Raul Castro, Ricardo Aleman, Ricardo Arias, Roberto Lewis, Roberto Vidal, Securities and Capital Markets_news, Ship Finance and Registration_news, Shipping and Admiralty Litigation_news

Morgan & Morgan receives top rankings in IFLR1000 2023.

Panama, October 3, 2023. Once again, Morgan & Morgan consolidates its position as a leading law firm in Panama in the 2023 IFLR1000 rankings for firms and lawyer ratings for Latin America. Firm´s rankings Banking and Finance: Tier 2 Capital Markets (Debt & Equity): Active M&A: Tier 2 Project Development: Tier 1 Individual ratings Francisco

Latin Lawyer 250, 2024: Highly Recommended

Panama, September 22, 2023. Once again, Latin Lawyer 250, 2024 edition, recommended Morgan & Morgan in the areas of Banking and Finance and Corporate and M&A. Banking and Finance “Morgan & Morgan´s banking and finance department frequently represents lenders during project finance deals, credit facilities and refinancing transactions. This practice group also includes capital markets

Morgan & Morgan outstands in Chambers Latin America 2024.

Panama, August 24, 2023. Once again, Morgan & Morgan consolidates its position as the leading law firm in Panama in Chambers Latin America Guide 2024, the key reference point of Latin American top law firms. The firm achieved 22 top individual rankings in 7 practice areas, the highest number for a Panamanian law firm. The

- Published in News, Allen Candanedo, Ana Castillo, Banking and Finance_news, Energy and Natural Resources_news, Francisco Arias, Francisco Linares, Inocencio Galindo, Intellectual Property_news, Jazmina Rovi, Jose Carrizo, Juan David Morgan Jr, Kharla Aizpurua, Litigation and Dispute Resolution_news, Luis Raven, Luis Vallarino, Mayte Sanchez, Omar Rodriguez, Orlando Tejeira, Ramon Varela, Ricardo Arias, Roberto Vidal, Securities and Capital Markets_news, Shipping and Admiralty Litigation_news, Simon Tejeira

Morgan & Morgan outstands in WWL: Central America 2023.

Panama, August 1, 2023. Once again, Morgan & Morgan leads the Panama section of Who´s Who Legal (WWL): Central America 2023, achieving the most recommended number of lawyers in Panama. The publication endorsed nineteen lawyers of the firm in the following practice areas Banking, Finance & Projects: Francisco Arias G. Inocencio Galindo Ramón Varela Ana

- Published in News, Albalira Montúfar, Allen Candanedo, amanda_barraza_publi, Ana Castillo, Banking and Finance_news, Barraza Amanda, Carlos Ernesto Gonzalez, Corporate Services_news, Energy and Natural Resources_news, Francisco Arias, Francisco Linares, Inocencio Galindo, Intellectual Property_news, Jazmina Rovi, Jose Carrizo, Juan David Morgan Jr, Labor Law_news, Litigation and Dispute Resolution_news, Luis Manzanares, Luis Vallarino, Maria Teresa Mendoza, Projects_news, Ramon Varela, Real Estate_news, Ricardo Aleman, Rishi Mungal, Rishi_mungal_publi, Roberto Lewis, Rodrigo Arias, Shipping and Admiralty Litigation_news, Simon Tejeira, Taxation_news

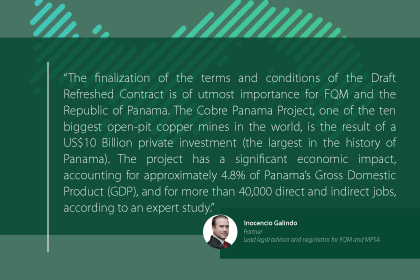

Morgan & Morgan advised Minera Panama, S.A., in negotiating a Refreshed Concession Agreement with the Government of Panama for the Cobre Panama Project, the largest private investment in the history of Panama.

Panama, March 9, 2023. Morgan & Morgan acted as lead Panamanian legal counsel to First Quantum Minerals Ltd. (“FQM”) and Minera Panama, S.A. (“MPSA”), a subsidiary of FQM, in all aspects related to the negotiations with the Government of Panama for a refreshed mining concession agreement for the Cobre Panama Project (the “Draft Refreshed Contract”). On

Morgan & Morgan outstands in The Legal 500 Latin America 2023.

Panama, October 20, 2022. With 27 attorneys and seven ranked practices, Morgan & Morgan heads the Panama chapter of The Legal 500 Latin America 2023 edition. In addition, eight practice areas receive the top Tier 1 ranking in the publication. The 27 attorneys of the firm recommended by this reference publication are: Allen Candanedo: Intellectual Property. Amanda Barraza:

- Published in News, Allen Candanedo, amanda_barraza_publi, Ana Castillo, Aristides Anguizola, Banking and Finance_news, Barraza Amanda, Corporate Services_news, Energy and Natural Resources_news, Fanny Evans, Francisco Arias, Francisco Linares, Inocencio Galindo, Intellectual Property_news, Jazmina Rovi, Jose Carrizo, Juan David Morgan Jr, Kharla Aizpurua, Labor Law_news, Laura Barrios, Litigation and Dispute Resolution_news, Luis Manzanares, Luis Miguel Hincapie, Luis Raven, Luis Vallarino, Maria Teresa Mendoza, Mayte Sanchez, Mergers and Acquisitions_news, Milagros Caballero, Nestor Broce, Omar Rodriguez, Ramon Varela, Raul Castro, Ricardo Aleman, Ricardo Arias, Roberto Lewis, Roberto Vidal, Shipping and Admiralty Ligitation, Taxation_news

Morgan & Morgan advised MMG Bank Corporation in connection with a financing to be granted in favor of Daconan Star Solar, S.A.

Panama, September 8, 2022. Morgan & Morgan represented MMG Bank Corporation (“MMG Bank”), as lender, in a financing to be granted in favor of Daconan Star Solar, S.A. (“Daconan”), to be used for expansion, by 2.64 additional megawatts of the capacity of a photovoltaic project called “Daconan Solar”, with an installed capacity of 3.24 megawatts,

- Published in Ana Castillo, Banking Law, Energy, expertise, Miguel Arias publi, Miguel Arias_exp, Projects, Ramon Varela

Morgan & Morgan outstands in Chambers Latin America 2023.

Panama, August 30, 2022. Once again, Morgan & Morgan leads the Panama ranking in Chambers Latin America Guide 2023, the key reference point of Latin American top law firms. The firm achieved 21 top rankings in 7 practice areas, the highest number for a Panamanian law firm. The recommended attorneys are: Allen Candanedo: Intellectual Property.

- Published in Allen Candanedo, Ana Castillo, Banking and Finance_news, Energy and Natural Resources_news, Francisco Arias, Francisco Linares, Inocencio Galindo, Intellectual Property_news, Jazmina Rovi, Jose Carrizo, Juan David Morgan Jr, Kharla Aizpurua, Litigation and Dispute Resolution_news, Luis Vallarino, Mayte Sanchez, News, Omar Rodriguez, Orlando Tejeira, Ramon Varela, Ricardo Arias, Roberto Lewis, Roberto Vidal, Securities and Capital Markets_news, Shipping and Admiralty Litigation_news, Simon Tejeira