FAQ: Invoices and Account Statements

Who should I call if I have concerns about my annuity, assignment invoice or account statement?

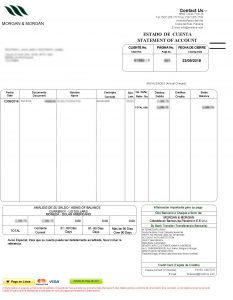

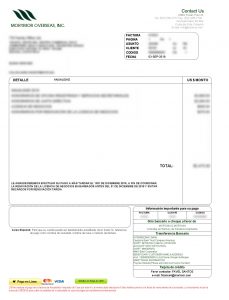

Please contact the collection officer in charge of your account. His/her name and contact details appear in the lower right part of your invoice or account statement. You may call or send an email.

What is an annual invoice?

It is the document issued by Morgan & Morgan showing the amount of the fees, expenses and taxes caused and/or to be caused by the provision of a service, namely: (i) Resident Agent of a company, private interest foundation, trust or vessel; (ii) Board of Directors; (iii) Foundation Council; (iv) Trustee; as well as the amount of the annual tax payable by corporations, limited liability companies and private interest foundations constituted under the laws of Panama, invoiced once every year for handling, representation and filing.

What is the Resident Agent?

Panamanian law requires that companies, trusts and foundations constituted, or vessels registered under its laws appoint a Resident Agent, who must be a lawyer or law firm, licensed to practice law in Panama. Unless otherwise stated in the constitution documents of the entity, the Resident Agent is not authorized to bind or represent the entity in question.

The Resident Agent has no legal standing to be served on behalf of the juridical entity. The faculties of the Resident Agent include keeping the records required from juridical entities constituted under the laws of the Republic of Panama with which a professional relation is kept; apply Know Your Client measures, legal requirements and provisions set forth by the Republic of Panama to such end; file before a notary for their protocolization, minutes and/or certifications or extracts of minutes of directors’ and/or shareholders’ meetings of juridical entities; act as link for the payment of the annual tax of corporations and foundations.

What is the annual tax:

It is the levy established by law to be paid annually by corporations and private interest foundations constituted under the laws of Panama to remain in good standing. Payment of this tax should be made through the Legal Representative of Resident Agent of the corporation or private interest foundation.

What is the movable corporeal property and service tax (ITBMS/VAT)?

The ITBMS (for its initials in Spanish) known in other countries as VAT, is the tax payable for the transfer or transmission of movable property made in Panama and the rendering of specified services, including legal services. Presently, it is 7%.

What is the term to pay the Annual Tax and what are the surcharges and penalties for late payment?

Below you will find the information on the terms for payment of the Annual Tax as well as the amount of the surcharges and penalties, according to the jurisdiction where the juridical person is organized. Payment of the Annual Tax must be received 5 working days prior to the due date shown in the table, to ensure timely payment to the Register.

Panamanian Cos. – 1st Semester:

Companies constituted between January-June

| Amount of Annual Tax | Due Date | Surcharge (as of July 16) |

Penalty is imposed every 2 years after 2 consecutive default terms |

Handling charge |

| US$300.00 | July 15 | US$50.00 | US$300.00 | US$25.00 +ITBMS |

Panamanian Foundations

| Amount of Annual Tax | Due Date | Surcharge (as of July 16) | Penalty is imposed every 2 years after 2 consecutive default terms | Handling charge As of July 16 |

| US$300.00 | July 15 | US$50.00 | US$300.00 | US$25.00 +ITBMS |

Panamanian Cos. – 2nd Semester:

companies constituted between July-December

| Amount of Annual Tax | Due Date | Surcharge (as of July 16) | Penalty is imposed every 2 years after 2 consecutive default terms* | Handling charge As of July 16 |

| US$300.00 | January 15 | US$50.00 | US$300.00 | US$25.00 +ITBMS |

*Failure to pay the annual tax for two consecutive terms (2 years) will cause in addition to the annual surcharge, a penalty of three hundred dollars (US$300.00).

** Failure to pay the annual tax for three consecutive terms (3 years) will cause in addition to the annual surcharge, the penalty for defaulting 2 terms plus a suspension notice of one thousand dollars (US$1,000 + expenses + fees + VAT).

BVI Cos – 1st Semester

Companies constituted between January-June

|

Amount of Annual Tax |

Due Date |

10% surcharge (June 1 to July 31) |

50% surcharge (Aug 1 to October 31) |

STRUCK OFF FROM REGISTER |

May 1 Restoration |

Handling fee |

| US$450 (Capital up to US$50,000) |

May 31 |

US$45.00 | US$225.00 | US$500.00 | US$1,500.00 | US$25.00 |

| US$1,200 (Capital over US$50,000) | US$120.00 | US$600.00 | US$500.00 | US$1,500.00 | US$25.00 | |

| US$450.00 (unspecified capital) | US$45.00 | US$225.00 | US$500.00 | US$1,500.00 | US$25.00 |

BVI Cos. -2nd Semester:

companies constituted between July-December

|

Amount of Annual Tax |

Due Date |

10% surcharge (Dec 1 to January 31) |

50% surcharge (Feb 1 to April 30) |

STRUCK OFF FROM REGISTER (May 1 to October 31) |

Nov 1 (restoration) |

Handling fee (Charged only in case of payment after Due Date) |

| US$450 (capital up to US$50,000) |

Nov 30 |

US$45.00 | US$225.00 | US$500.00 | US$1,500.00 | US$25.00 |

| US$1,200 (capital over US$50,000) |

US$120.00 |

US$600.00 |

US$500.00 |

US$1,500.00 |

US$25.00 | |

| US$450.00 (unspecified capital) | US$45.00 | US$225.00 | US$500.00 | US$1,500.00 | US$25.00 |

Belize Cos.

|

Annual License fee |

Due Date | 50% surcharge (Nov 1 to Dec 31) | Struck off from Register (Jan 1 to June 30) |

July 1(restoration) |

Handling fee |

| US$150.00 (Capital up to 50,000.00) |

July |

US$75.00 | US$500.00 | US$1,000.00 | US$25.00 |

| US$1,000.00 (Capital over 50,000.00) | US$500 | US$500.00 | US$1,500.00 | US$25.00 | |

| US$350.00 (unspecified capital) | US$175 | US$500.00 | US$1,000.00 | US$25.00 |

Bahamas Cos.

|

Annual License fee |

Due Date | 10% surcharge (April 1 to Oct 31) | 50% surcharge (Nov 1 to Dec 31) |

Struck off from Register (Jan 1) |

Struck off from Register (Annual penalty)* |

Handling fee |

| US$350 (Capital up to US$50,000) |

March |

US$35.00 | US$175 | US$600.00 | $150.00 | US$25.00 |

| US$1,000(Capital over US$50,000) | US$100.00 | US$500.00 | US$600.00 | $150.00 | US$25.00 |

* The annual penalty is for every year the company remains struck off at the Register.

* After 2 years struck off at the Register, the restoration fee for the company increases from US$600.00 to US$1,000.00

Important Note on Belize and Bahamas companies

TTo carry out any legal transactions in these jurisdictions, payment of the license fee is required.

Important Note on companies from other jurisdictions

For queries regarding due dates of companies in jurisdictions not listed above, please contact the collections officer in charge of your account.

What is a suspension notice?

It is the penalty imposed by the General Revenue Office of the Republic of Panama to all corporations and foundations registered under Panamanian law that have failed to pay their annual tax for more than three (3) years at the Public Register of Panama, which penalty, according to paragraph 2, Article 318-A of the Tax Code of the Republic of Panama, suspends all corporate rights of said entities.

Why the due diligence?

Compliance rules and Due Diligence procedures required in the various jurisdictions where Morgan & Morgan provides legal services, as well as policies from multilateral organizations (such as FATF and OECD) have had an impact on resident agents who incorporate companies, causing a direct increase in our costs to provide such services. Our firm has included since the year 2015, a recurring due diligence annual fee of US$50.00. We must underline that this fee is made per client and not per vehicle. This means that, if you have more than one company, you will only be changed US$50.00 a year.

What should I do legally when I no longer want to keep a company or private interest foundation active?

The procedure under the law, when a client does not want a company or foundation to continue to be active, is to apply for its dissolution and liquidation, by contacting the office or lawyer that provide services to the client.

What forms of payment may I use?

On line credit card payment through the link provided on the account statements and/or invoices, and in our webpage; by international wire transfer; by ACH though local banks, and/or check; other currencies (Euro and Swiss Francs).

Information on bank routes appear in the lower part of your invoice and account statement.

Who should I contact in case of queries about the content of an invoice?

Please contact the Attorney directly for queries regarding:

- Rates

- Fees agreements signed

- Any expenses invoiced

- If you want to discontinue the company (in case of annual fees)

- Evidence of the invoice (assignments) delivered

- Changes in the address and/or name of the invoice

- Copy of the assignment invoice

Please contact your collections officer for queries related to:

- Payment confirmations

- Due dates (in case of annual fees)

- Request of account statement

- Information on forms of payment

- Payment history (invoicing and payments to account)

- If you want us to pick-up checks

Morgan & Morgan credit policies

Unless otherwise agreed based on volume, all services shall be settled upon presentation of the relevant invoice.

Handling fee: a US$25.00 + VAT handling fee will be charged for late payment of annual invoices in PANAMA, BVI, BELIZE and BAHAMAS.