Panama, March 20, 2025.

Law No. 462 of March 18, 2025, introduces several significant reforms to Panama’s Social Security Fund (CSS). These reforms aim to rescue the system from insolvency, ensure the sustainability of the Disability, Old Age, and Death Regime, and improve the quality of healthcare service management.

From this extensive new law, the following key points can be highlighted:

No Increase in Retirement Age: This reform does not include the previously proposed increase in the retirement age. However, a review is scheduled within six years. Until then, the retirement age remains 57 years for women and 62 years for men.

Unified Solidarity Capitalization System: The law establishes a system financed through a Unified Solidarity Fund, structured into two components:

-

Non-Contributory Solidarity Component: Grants a minimum pension of B/. 144.00 to individuals who were unable to make sufficient contributions during their working life or a solidarity benefit pension, the amount of which depends on the insured’s contributions.

-

Contributory Solidarity Capitalization Component: Provides a Guaranteed Solidarity Pension, based on the accumulated contributions in the individual accounts of affiliates, according to their contributions.

Increase in Employer Contributions: A gradual increase in employer contributions is established as follows:

- 13.25% upon the law’s entry into force until February 28, 2027.

- 14.25% from March 1, 2027, until February 28, 2029.

- 15.25% from March 1, 2029, onwards.

Elimination of Old Age Compensation: As of 2036, the Social Security Fund will no longer grant old-age compensation. Instead, it will calculate a retirement pension based on the Unified Capitalization System with Solidarity Guarantee.

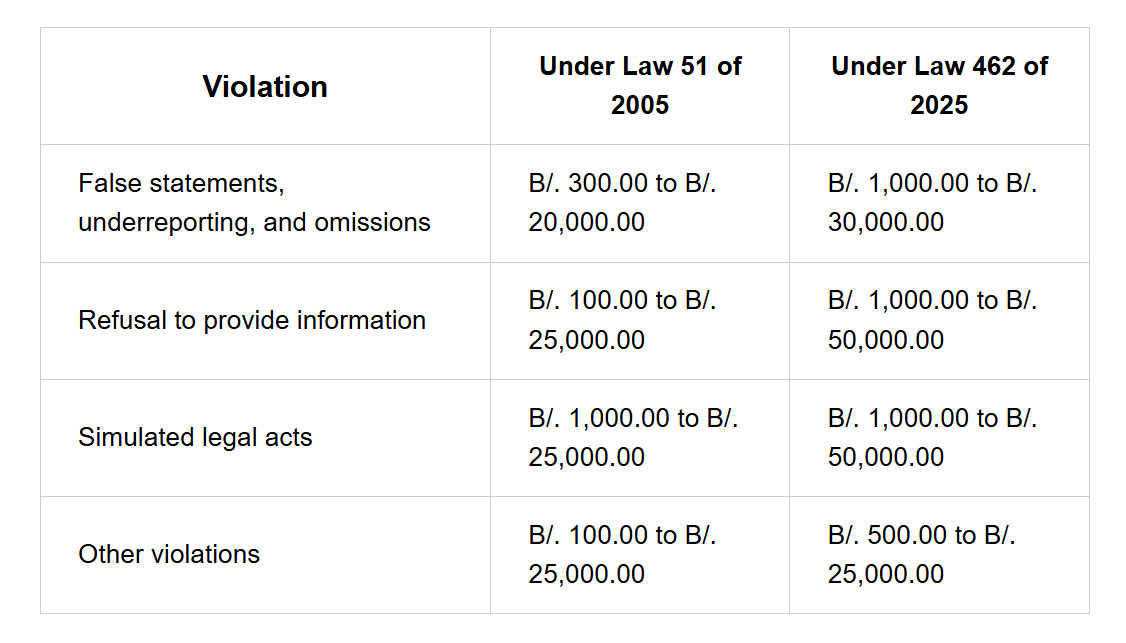

Increase in Fines for Non-Compliance:

It is important to note that the initial increase of 13.25% must be applied as of the effective date of the law, which has already taken place on March 18, 2025. However, in a statement issued on March 21st, the Social Security Fund indicated that this first increase will apply starting in April, corresponding to the payroll to be paid in May. This is subject to the implementation of the update in the Economic Benefit System (SIPE), so that companies can see the increase in the employers contribution rate when processing payroll payments.

Other additional key provisions to take note of:

-

Extension of Joint and Several Liability for Employer Substitution: The liability of the substituted employer in cases of employer substitution is extended to two years.

-

Mandatory CSS Affiliation for Independent Professionals: Independent professionals are now required to register with CSS, with a contribution rate of 9.36% of taxable income to cover Disability, Old Age, and Death (IVM) benefits. Additionally, an 8.5% contribution is established for health and maternity risks (the latter is voluntary).

-

Automatic Enrollment Through Links with the Ministry of Labor: This system must be implemented within 24 months following the law’s entry into force.

For more information, please contact our Labor & Employment Law team: [email protected].