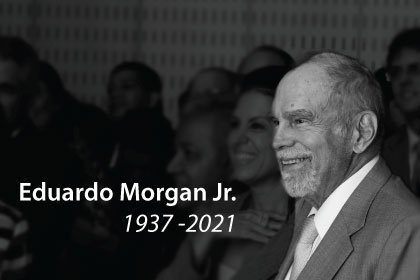

In memoriam – Eduardo Morgan González

It is with great sadness that we inform of the passing of our beloved founding partner Eduardo Morgan González on July 8 at the age of 84. Man of letters and business, prestigious jurist, diplomat and politician, Mr. Eduardo Morgan was born in the city of David, Chiriqui, later moving to Panama City. He earned

- Published in News

The Ministry of Health modifies the requirements to enter into the country, applicable to Panamanian or residents coming from the United Kingdom, South Africa, India or South America.

The Ministry of Health (hereinafter “MINSA” for its acronym in Spanish) through Executive Decree No. 783 of June 18, 2021 (hereinafter the “Decree”), modifies the requirements to enter to Panama, applicable to Panamanian or residents coming from, who have stayed or transited through the United Kingdom, the Republic of South Africa, India or South America

- Published in Immigration Law_news, News

Morgan & Morgan among the 100 companies with the Best Corporate Reputation in Panama, Social Responsibility and Good Governance in Panama

For the third consecutive year, the Corporate Reputation Business Monitor (MERCO) presented the Ranking of Companies 100, Leaders 75 and Social Responsibility and Good Governance 100, corresponding to business action in 2020, a year marked by the COVID-19 pandemic. We are pleased to announce that Morgan & Morgan was the only Panamanian law firm included

- Published in News

Morgan & Morgan´s NGO (Fundamorgan) celebrates its twentieth-anniversary

Morgan & Morgan´s NGO (Fundamorgan) celebrates its twentieth-anniversary. The Foundation was established to honor the memory of Eduardo Morgan Alvarez (1902-1988), founder of Morgan & Morgan, a self-taught lawyer by vocation who dedicated his life to the successful exercise of the law, to procure an equal access to justice and to serve his country. Panama,

- Published in News

Time Bar for In Rem Claims Under Panamanian Law

Recently, as a member of the International Maritime Law Seminar (“IMLS”), Morgan & Morgan collaborated with an article for the IMLS’ newsletter published due to the cancellation of the annual IMLS events in London and Singapore as a consequence of the Covid-19 pandemic. Our attorney Andrés V. Mejía, from the Shipping & Admiralty Department, wrote

- Published in News, Shipping and Admiralty Litigation_news

Jose Carrizo participates in the Asset Recovery Americas conference

Jose Carrizo, partner and head of the Litigation and Dispute Resolution practice of Morgan & Morgan, participated as speaker in the “Asset Recovery Americas: Fraud Litigation, Contentious Insolvency and Enforcement in the Americas” conference, a seminar series for fraud and insolvency practitioners. The activity was organized by Informa Connect, a major brand in events and

- Published in Jose Carrizo, Litigation and Dispute Resolution_news, News

Changes to the requirements to obtain the “residence permit as friendly nations”

The Ministry of Public Security modifies the requirements to request the residence permit for foreigners from specific countries who maintain friendly professional, economic and investment relationship with the Republic of Panama. The Ministry of Public Security through Executive Decree No. 197 of May 7, 2021 (hereinafter the “Decree”), modifies the requirements to obtain the residence for foreigners

- Published in Immigration Law_news, News

Short Stay Visa as a Remote Worker (Digital Nomad)

The Government of the Republic of Panama, in response to the new modalities of work worldwide, among these, remote working, considered it appropriate to create this subcategory within the Non-Resident Visas. Executive Decree No. 198 of May 7th, 2021 (hereinafter, the “Decree”), published in the electronic Official Gazette on May 20th, 2021, creates the Short

- Published in Immigration Law_news, News

Who´s Who Legal recognizes Albalira Montufar as a Leading Immigration Lawyer in Panama

We are proud to announce that our partner Albalira Montufar was selected as Leading Immigration Lawyer in Panama byWho´s Who Legal (WWL) Central America 2021 edition, a comprehensive guide to the region’s legal market, including the most highly regarded firms and individuals across Belize, Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Nicaragua, and Panama. Ms. Montufar

- Published in Immigration Law_news, News

Terralex Cross-Border Data Protection Guide 2021

Partner Kharla Aizpurua Olmos contributed with the Panama chapter of the Terralex Cross-Border Data Protection Guide, a publication produced by members from around the globe of the Technology & Digital Business Industry Sector Team of Terralex. With the ever-changing technology and responding legislation, businesses must be prepared to handle a patchwork of data protection regulations. This guide

- Published in News